By Angie Girard

I turned 62 this month, in the nick of time. On my birthday, Brian and I submitted our application to become registered domestic partners, which among other things, will save me thousands in healthcare insurance premiums and related healthcare expenses.

Long story short, we have been together for over 20 years and have a healthy skepticism of marriage (been-there-done-that, and too many other reasons to enumerate here). When I decided to retire at 59, health insurance was an enormous factor. To be covered as a dependent on Brian’s insurance we had to be married or be registered domestic partners. As noted, marriage was out of the running so we looked at the pros and cons of WA State registered domestic partnership law. One of the requirements, if you’re not a same-sex couple, is that one of you must be 62 years of age. Thus, this birthday = domestic partnership. In the interim, I have had health insurance through the Affordable Care Act (ACA) marketplace.

Most of you know there are devastating changes on the horizon for Medicare and Medicaid, AND the ACA marketplace will be eviscerated.

Almost 1 in 7 US residents had enrolled in a marketplace plan at some point during the first 10 years of its existence. More people than ever before, over 24 million, signed up for marketplace coverage for 2025. These are people under age 65 (because Medicare kicks in at 65) who work for small companies that don’t have employer-based coverage, or they work fewer than 30 hours a week thus don’t qualify for their employer-based plan, or are self-employed, or work a gig job (or jobs), or, or, or . . . The point is, they are income-earning, tax-paying US residents, most of whom would otherwise be without health insurance.

Of those on a marketplace insurance plan, about 92% of us receive a subsidy through premium tax credits and cost-sharing reductions based on our income. Think about this like employer-based insurance premiums; the employer pays a portion, and the employee pays a portion. Most of us don’t pay attention to what our employer pays, nor do those of us on the marketplace pay attention to what the government pays—though we should, because it is a LOT (more on this below). I was unable to find the average marketplace premium for family vs individual, so the average of all enrollees is provided in the right column of the table. Look at the amounts the employers and federal government pay. DAMN!

US Average Monthly Health Insurance Premiums 2024

| Employer-Based Health Insurance | Marketplace Health Insurance | |||

| Single | Family | Per person average for all enrollees | ||

| Total Cost | $746 | $2,131 | Total Cost | $603 |

| Employer portion | $626 | $1,598 | Federal Subsidy | $536 |

| Employee portion | $120 | $533 | Insured portion | $67 |

Sources: https://thatch.com/blog/average-employee-health-insurance-cost-per-month and https://www.cms.gov/files/document/effectuated-enrollment-early-snapshot-2025-and-full-year-2024-average.pdf

The marketplace federal subsidies (like the employer-paid portion) make your premium portion affordable which is why more Americans have health insurance than ever before. Since the ACA’s major coverage provisions were implemented in 2013, the number of people with health insurance coverage has grown by more than 38 million, and the nation’s uninsured rate has nearly halved, falling from 14.4% in 2013 to 7.9% in 2023. Amazing! More people with health insurance coverage, especially healthy people, means lower premiums. Healthy people in the risk pool offsets the higher costs of sicker people (which was one of the core arguments of the ACA). But premiums have instead increased. A LOT. The insurance industry blames requirements on covering pre-existing conditions and more comprehensive benefits as well as general increase in overhead costs for the rise in premiums.

Okay, so let’s give the healthcare insurance industry the benefit of the doubt. They had to raise premiums so everything would be copasetic, stable, proportional, right?

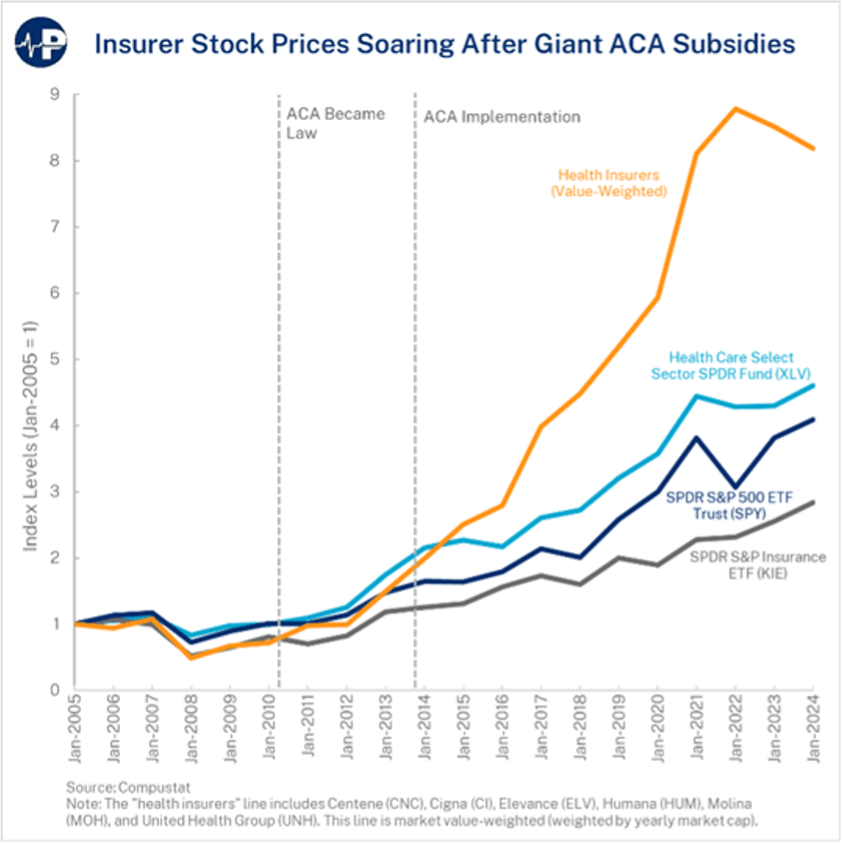

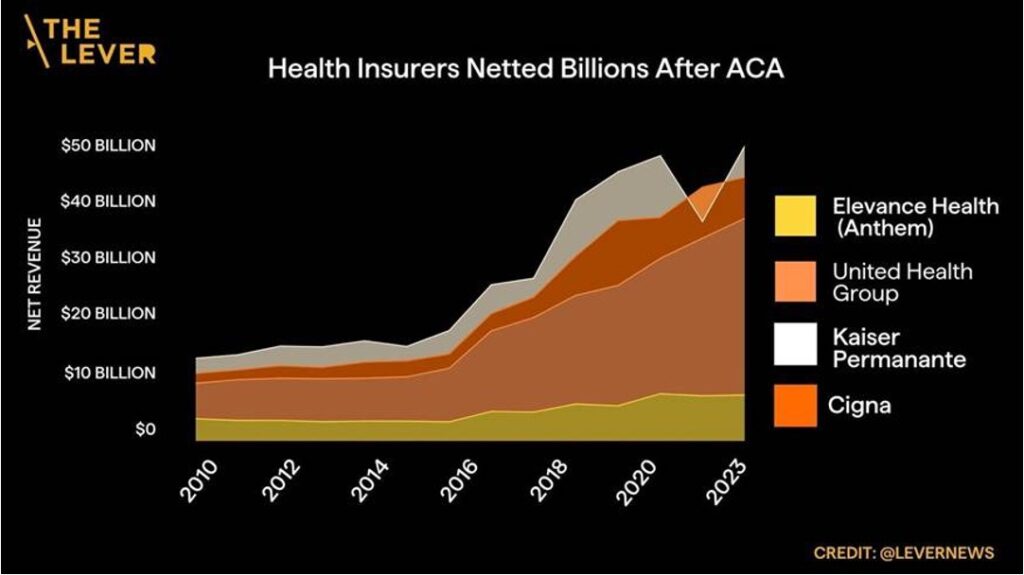

Then explain to me why health insurers had profits of more than $371 billion and health insurers’ stock prices were up 448% (far outpacing the S&P 500) over that same ten-year period. That my friends, is pure greed. The tax credit and subsidies mentioned previously are paid directly to the insurance carrier by the federal government and can be anywhere from $1 to well over $1000 each month, per person. Congress (ALL OF THEM) were asleep at the wheel until the Big Bullshit Bill raised its ugly head.

Further, there are now fewer private health insurance companies than a decade ago. A more concentrated market leads to less competition, less consumer choice, and even higher premiums (ahem, price fixing?).

So, back to ACA marketplace insurance. The enhanced premium tax credits (ePTC) are set to expire December 31, 2025. The ePTC applies to those who have an income 400% above the federal poverty level (FPL) and get their insurance through the marketplace (about 80,000 people just in WA state). The FPL is $15,650 for a single person, household of one (which is RIDICULOUSLY low, but that’s a rant for another day). So, if that’s you and your income is more than $62,600 and have insurance through the marketplace you will pay the full premium. AND premiums are expected to increase. According to WA Insurance Commissioner Patty Kuderer, fourteen health insurers have requested an average rate change of 21.2% for Washington state’s 2026 Individual Health Insurance Market. As shown above in US Average Monthly Health Insurance Premiums 2024 table, the marketplace average premium was $603 (BTW 2025 average is $619). The total premium for the plan I selected (based on multiple factors like being in WA state, ability to keep my physicians/providers, deductible amount, my age, Rx, breadth of coverage, etc.) was $1202/month. Obviously, there is a wide range in premiums, everything from catastrophic only with high deductible to comprehensive with very low deductible. My point is, if I kept this coverage—which DOES NOT INCLUDE vision or dental—the premium will likely be $1455 a month for 2026. I’m not above the 400% FPT so I would continue to receive some premium tax credit, but not much. Let’s suffice to say, it would eat up about one-quarter of my monthly income.

But wait, there’s more. The year-round special enrollment period for low-income individuals ended last month (Aug. 2025). They now must wait for the regular open enrollment period and thus have no coverage while they wait. The open enrollment period is getting shorter in 2026, from Nov. 1 to Dec. 15 (previously until January). DACA recipients are no longer eligible. Income verification is much stricter. The grace period to correct errors is shorter. The required individual premium contribution percentage increases in 2026. The Premium Tax Credit is lower. And, and, and. . . and this is why it is projected that approximately 2.2 million will not be insured via the marketplace in 2026 impacting the insurance pool which in turn raises premiums . . . BUT, the insurance companies will continue to rake in profits. Have no doubt about that.

So, what can you do?

Understand that both parties are to blame for the continued fleecing of the working class that has created billions in profits for insurance companies. Those are OUR tax dollars in their pockets. This has been going on for decades but exploded after the ACA was implemented. See also: Why the US doesn’t have national health insurance: The political role of the AMA | CEPR

What Can You Do?

Contact your members of congress TODAY. Tell them that not only do you want all the proposed changes to Medicare, Medicaid, and the Marketplace rescinded, you also want universal health coverage (see: Universal health coverage (UHC)). If they don’t make this a priority, they don’t get your vote in the next election (assuming we have a next election). It is truly absurd that the US is the only wealthy industrialized country in the world that does not have universal health coverage. And it is even more absurd that we spend almost double per person on inpatient and outpatient care than our peer countries, yet we die younger and are less healthy. See: International Comparison of Health Systems | KFF, Global Perspective on U.S. Health Care | Commonwealth Fund, How Other Countries Achieve Universal Coverage, and Universal Health Coverage Globally | Commonwealth Fund

Maria Cantwell:

- 511 Hart Senate Office Building Washington, DC 20510

- (202) 224-3441

- Contact

Patty Murray:

- 154 Russell Senate Office Building Washington, DC 20510

- (202) 224-2621

- Contact

Dan Newhouse

- 460 Cannon House Office Building

- (202) 225-5816

- Contact

If you are not in CD 4, find your member of congress here: Find Your Members in the U.S. Congress | Congress.gov | Library of Congress

Get up to speed on Whole Washington. I’m doing a deep dive now.

Feel free to share this article.

Thanks for reading,

Angie, lucky to be 62!

Sources:

https://jacobin.com/2024/12/health-insurance-profits-unitedhealthcare-aca

https://paragoninstitute.org/newsletter/the-aca-is-making-health-insurers-much-richer/

https://www.wahbexchange.org/blog_080125/